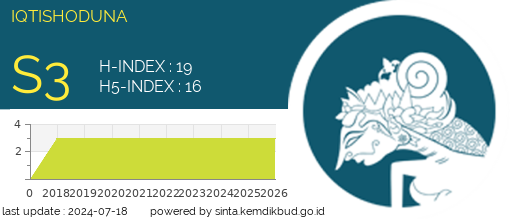

IQTISHODUNA

Published past Universitas Islam Negeri Maulana Malik Ibrahim Malang

ISSN : 1829524X EISSN : 26143437 DOI : -

Core Subject : Economy,

IQTISHODUNA Jurnal Ekonomi dan Bisnis Islam merupakan jurnal yang fokus terhadap kajian-kajian yang berkaitan dengan bidang Ekonomi dan Manajemen, yang meliputi beberapa sub bidang, yang diantaranya adalah Ekonomi Islam, Manajemen Bisnis, Manajemen Pemasaran, Manajemen Sumberdaya Manusia, Manajemen Keuangan, dan lain-lain.

Arjuna Subject : -

Articles 8 Documents

Search results for , issue "IQTISHODUNA (Vol three, No 2" : eight Documents articulate

PENENTUAN PORTOFOLIO YANG EFISIEN BAGI CALON INVESTOR PADA INDUSTRI OTOMOTIF DAN KOMPONENNYA YANG TERDAFTAR DI BURSA EFEK SURABAYA IQTISHODUNA IQTISHODUNA (Vol 3, No 2 Publisher :

Fakultas Ekonomi, UIN Maliki Malang Testify Abstract | Download Original | Original Source | Cheque in Google Scholar | Total PDF (227.185 KB) | DOI: 10.18860/iq.v2i2.220

This study aimed to determine efficient portofolio for prospective investor in automotive industries and their component that list in Bursa Efek Surabaya in order to decrease hazard, by comparing expected render and risk earlier and after portofolio and choose efficient portofolio amid these portofolios. The results of the report revealed that by making  portofolio investor will get more than expected return and decrease risk. ANALISIS RASIO KEUANGAN UNTUK MENEMUKAN Banking concern JANGKAR (STUDI PADA BANK UMUM SYARIAH DI INDONESIA) Drs. Agus Sucipto, MM.,, Achmad Zainuri, SE IQTISHODUNA IQTISHODUNA (Vol three, No 2 Publisher :

Fakultas Ekonomi, UIN Maliki Malang Show Abstruse | Download Original | Original Source | Check in Google Scholar | Full PDF (294.375 KB) | DOI: 10.18860/iq.v2i2.222

This enquiry based on API, anchor bank, and the growth of syariah commercial bank (Charabanc). This research aims to description BUS financial ratio with documentary technic in collecting information. This research use secondary data in form of financial report. Instrument assay is banking financial ratios with time series analysis and cantankerous exclusive arroyo equally tekhnis analysis. The research shows that syariah commercial bank have potential to be an anchor bank, merely PT. Bank Muamalat Indonesia have more potential according to his financial ratios. ANALISIS PENGARUH FAKTOR MOTIVASI DAN FAKTOR KEPEMIMPINAN TERHADAP SEMANGAT KERJA PEGAWAI UIN MALANG Sani, SE, Chiliad.Si.,, Achmad IQTISHODUNA IQTISHODUNA (Vol 3, No ii Publisher :

Fakultas Ekonomi, UIN Maliki Malang Show Abstract | Download Original | Original Source | Cheque in Google Scholar | Total PDF (270.85 KB) | DOI: 10.18860/iq.v2i2.223

Work ethos is behavior managed past employee which is generally motivated to reach a set of goal. This research investigates the extent to which motivation and style in leadership impacts on the work ethos of employee. This inquiry sets its goal to know the significant influence of motivation toward the work ethos of employee of Islamic State Academy of Malang.This is an explanatory research which has its goal to test defined hypothesis on the influence of motivation and style in leadership toward the work ethos of employee. The research population involves 58 assistants staff of Islamic Country University of Malang. The random sampling method is employed to determine the total number of the sample of the research which results in 36 assistants staff. Questionnaire is used every bit research instruments in this research.This research employs unproblematic linier regression and multiple linier regression to statistically clarify the data in which the coefficient determinants is set on 0,05 level. The result of the inquiry analysis proves that motivation and style in leadership simultaneously give significant influence on the piece of work ethos of employee with F = 51,483 and p (0,002) 0,05. Motivation partially gives significant influence toward work ethos in which p = (0,001) 0,05 and regression coefficient shows 0,339. Leadership style partially gives meaning influence toward work ethos in which p = (0,000) 0,05 and regression coefficient shows 0,304.Based on the finding, it is further suggested that the policy maker in Islamic State University of Malang should give more attention to the motivation and leadership way used in the establishment. It is considering the result of this enquiry proves that motivation and manner in leadership simultaneously give significant influence on the piece of work ethos of the employee.   KEADILAN DAN KEBENARAN PERSPEKTIF AKUNTANSI SYARIAH Fahrudin A, SE., MM.,, Ahmad IQTISHODUNA IQTISHODUNA (Vol iii, No ii Publisher :

Fakultas Ekonomi, UIN Maliki Malang Evidence Abstract | Download Original | Original Source | Bank check in Google Scholar | Total PDF (378.444 KB) | DOI: 10.18860/iq.v2i2.224

Accounting with Islamic values based on the justice and truth that is in line with al-Qur’an and al-Hadist is a reality that should be achieved because Islamic networking in Syariah is not merely summarizing God’s volition. It is because the get-go Syariah source is God’due south words (al-Qur’an). This ‘Tauhid’ conventionalities is live in Syariah and in an Islamic community. Information technology is known that ‘Tauhid’ does not separate between social and spiritual lives. Bookkeeping formula based on the justice and truth must reverberate some items below: First, all of the corporation and organization elements had by the Moslems must reflect ‘zakat’; 2nd, Syariah Accounting must exist characterized by ‘zakat’ and ‘amanah oriented’; Tertiary, the accounting report blueprint must cover some elements every bit cash-period argument, current value residual sheet, and shariate value added argument (SVAS)     AN ANALYSIS ON MURABAHAH Applied IN BANK TABUNGAN NEGARA (BTN) SYARIAH MALANG Branch Hidayati, SE.,, Barida IQTISHODUNA IQTISHODUNA (Vol 3, No ii Publisher :

Fakultas Ekonomi, UIN Maliki Malang Prove Abstruse | Download Original | Original Source | Check in Google Scholar | Full PDF (224.46 KB) | DOI: ten.18860/iq.v2i2.225

This research is based on the practiced performance of murabahah financing on Indonesia Islamic Cyberbanking. The murabahah is one of the financing products that based on the Islamic trading principle which is preeminence the honest between the seller and the buyer. Co-ordinate to it, this enquiry investigates the transparency procedure in BTN Syariah including the transparency pre-akad, akad and later akad. This research is designed using qualitative method. To collect the data the researcher uses interview, observation and documentation, while for verifying data the researcher uses triangulation. The result of this inquiry explains that murabahah transparency is washed well in BTN Syariah Malang Co-operative, fifty-fifty it is found many problem on it. The problem found is identified on pre akad, on akad and before akad. the trouble on pre akad is establish around the depository financial institution explanation and the client agreement, the akad trouble is found around the akad reading and the akad signing while the after akad trouble is plant around the accelerate payment formula. ANALISIS SOLVABILITAS PERBANKAN SYARIAH DI Republic of indonesia PERIODE 2001 â€" 2004 Yuliana, SE., MM.,, Indah IQTISHODUNA IQTISHODUNA (Vol 3, No 2 Publisher :

Fakultas Ekonomi, UIN Maliki Malang Show Abstract | Download Original | Original Source | Check in Google Scholar | Full PDF (296.75 KB) | DOI: ten.18860/iq.v2i2.226

The birth of ‘Syariah Bank’ in Indonesia is really hoped by the Indonesians (especially the Moslems) who think that the interest of the bank       is forbidden in Islam. However actually sharing principle in the accounting institution has been known well both in Islamic and non-Islamic countries. ‘Syariah Bank’ is non related with religious rituals (Islam) just information technology is about a sharing concept in business between the owner of the capital letter and the capital managing director. Bank direction with syariah principle can be accessed and managed past all societies and non only by the Moslems. However, it is not debatable that nowadays in Republic of indonesia ‘Syariah Bank’ is developing within the Islamic societies. From this aspect, the opportunity to develop ‘Syariah Bank’ in Indonesia is big enough, equally Republic of indonesia is a country having the biggest Moslem followers. ‘Syariah bank’ equally an accounting intermediary institution is hoped to be able to give a better performance than the conventional banks. The goodness and the badness of the ‘Syariah Bank’ can be known from its performance reflected from the bookkeeping report. But the accounting report   on the Syariah Banking sector is to provide an information related to the bookkeeping position, functioning and besides accounting position, and bank activities that volition exist useful for the determination making.This research aims to describe the solvability ability of Syariah Depository financial institution in Indonesia based on the cyberbanking ratio analysis technique. This is a descriptive enquiry and the population of this enquiry is the Syariah Depository financial institution that has been doing IPO in BEJ.  The result of the enquiry shows:First, CAR ability from 2001 to 2004 its value is to a higher place the determined standard from BI. the CAR that is far higher up the standard shows that the bank has not used the capital maximally. This can be acquired by the bank’s doubt to distribute its capital to the run a risk ‘avails (aktiva)’. Second, debt to equity from 2001 to 2004 gets increased. It shows that the number of debt year by twelvemonth gets increased. Third, long term debt to equity from 2001 to 2003 whose values at the syariah banking industry is the smallest   is ‘Syariah Mandiri Bank’. While, in 2004 it is ‘Indonesian Muamalat Bank’. It means ‘Syariah Mandiri Bank’ and ‘Indonesian Muamalat Bank’ are the banks which its long term debt composition is under the industrial average, and so that the smaller the long term debt to disinterestedness ration, the smaller the banking concern ‘avails (aktiva)’ financed by the long term debt. ANALISIS PERBEDAAN Abnormal Return DAN TRADING Book Activeness SAHAM SEBELUM DAN SESUDAH PERISTIWA GEMPA DI YOGYAKARTA TANGGAL 27 MEI 2006 (Sudi Kasus pada Perusahaan Asuransi Terdaftar di Bursa Efek Dki jakarta) Istanti, SE., MM.,, Lulu Nurul IQTISHODUNA IQTISHODUNA (Vol 3, No 2 Publisher :

Fakultas Ekonomi, UIN Maliki Malang Show Abstruse | Download Original | Original Source | Cheque in Google Scholar | Full PDF (262.455 KB) | DOI: 10.18860/iq.v2i2.227

This research presents an empirical analysis of difference between abnormal return and trading volume activity before and after earths-quake, in Yogyakarta at May 27, 2006. And examine its statistical properties. This research argues that in that location was deviation betwixt abnormal return and trading book activity before and after quake. For this purpose, the mean difference test, using t-test, was applied to compare the mean value of aberrant render and trading volume activity before and after quake. The sample of this research consists of the insurance firms listed at the Jakarta Stock Exchange. Investigation on the sample firms involved periods of ten days before quake and ten days after quake. The results of this research indicate that there was no significant departure between the abnormal return and trading book activity before and later quake. This show confirms that even did not positively influence abnormal render and trading volume activity as suggested theoretically.   ANALISIS JARINGAN KOMUNIKASI UNTUK MENUNJANG KEGIATAN PEMASARAN PADA INDUSTRI KECIL Utami, Hamidah Nayati IQTISHODUNA IQTISHODUNA (Vol 3, No ii Publisher :

Fakultas Ekonomi, UIN Maliki Malang Show Abstruse | Download Original | Original Source | Check in Google Scholar | Full PDF (211.402 KB) | DOI: 10.18860/iq.v2i2.228

Pocket-sized industry marketing corelated with comunication process. There are communication process betwixt consumer and producer. The situational factors are support the advice process in group. This situations are comnunication network, comnunication behavior, group cohessivity, size of grouping.  This research aimed to draw communication process and marketing action on small-scale industry group of ceramics, and to examine the correlation of communication process and marketing activity on small industry group of ceramics. This study was conducted the craftsmen of ceramics at Dau district, Malang Regency. Sample taken with simple random sampling method. Survey and interview technique were implemented among 25 craftsmen. Data was analyzed by using communication network assay and tau Kendall. The results indicated that the craftsmen had a loftier level of individual connexion, a medium level of Individual Integration, but Individual Diversity was low. The level of intensity of craftsman marketing activity was low. The results indicated that of individual connection, a medium level of Individual Integration, but Individual Variety were depression were correlated with craftsmen’due south activity in promotion, product determining, placement, and pricing. Folio i of 1 | Total Record : eight

Filter By Issues

All Consequence IQTISHODUNA (VOL.17, No.2, 2021) IQTISHODUNA (VOL.17, No.ane, 2021) IQTISHODUNA (VOL.16, No.two, 2020) IQTISHODUNA (VOL.16, No.1, 2020) IQTISHODUNA (VOL.fifteen, No.2, 2019) IQTISHODUNA (VOL.15, No.1, 2019) IQTISHODUNA (VOL.fourteen, No. 2, 2018) IQTISHODUNA (Vol xiv, No. ane, 2018) IQTISHODUNA (VOL 13, NO: 2. IQTISHODUNA (VOL xiii, NO: ane. IQTISHODUNA (VOL 12, NO: ii. IQTISHODUNA (VOL 12, NO: 1. IQTISHODUNA (VOL 11, NO: ii. IQTISHODUNA (VOL xi, NO: ane. IQTISHODUNA (VOL 10, NO ii. IQTISHODUNA (VOL 10, NO 1. IQTISHODUNA (VOL 10, NO 1. IQTISHODUNA (VOL 9, NO 2. IQTISHODUNA (VOL 9, NO 1. IQTISHODUNA (VOL 9, NO 1. IQTISHODUNA (VOL viii, NO i IQTISHODUNA (Vol 8 No ii IQTISHODUNA (VOL 7, NO two IQTISHODUNA (Vol 7, No ane IQTISHODUNA (Vol 6, No 2 IQTISHODUNA (Vol vi, No 1 IQTISHODUNA (Vol five, No 3 IQTISHODUNA (Vol 5, No 2 IQTISHODUNA (Vol 5, No 1 IQTISHODUNA (Vol 4, No 3 IQTISHODUNA (Vol 4, No 2 IQTISHODUNA (Vol four, No ane IQTISHODUNA (Vol three, No 3 IQTISHODUNA (Vol 3, No ii IQTISHODUNA (Vol 3, No 1 IQTISHODUNA (Vol 2, No three More Consequence

What Is The Distinction Betweenã¢â‚¬â€¹ Cross-sectional Data Andã¢â‚¬â€¹ Time-series Data?,

Source: https://garuda.kemdikbud.go.id/journal/view/5274?issue=IQTISHODUNA%20(Vol%203,%20No%202

Posted by: hoangroustich1959.blogspot.com

0 Response to "What Is The Distinction Betweenã¢â‚¬â€¹ Cross-sectional Data Andã¢â‚¬â€¹ Time-series Data?"

Post a Comment